Before you begin this checklist, gather all the relevant information you need to enter into the system, such as bank statements, credit card bills, invoices, and payments. Update the system and set a cutoff date for data entry. Communicate this date to your finance and accounting teams so that you know when you can start the year-end close.

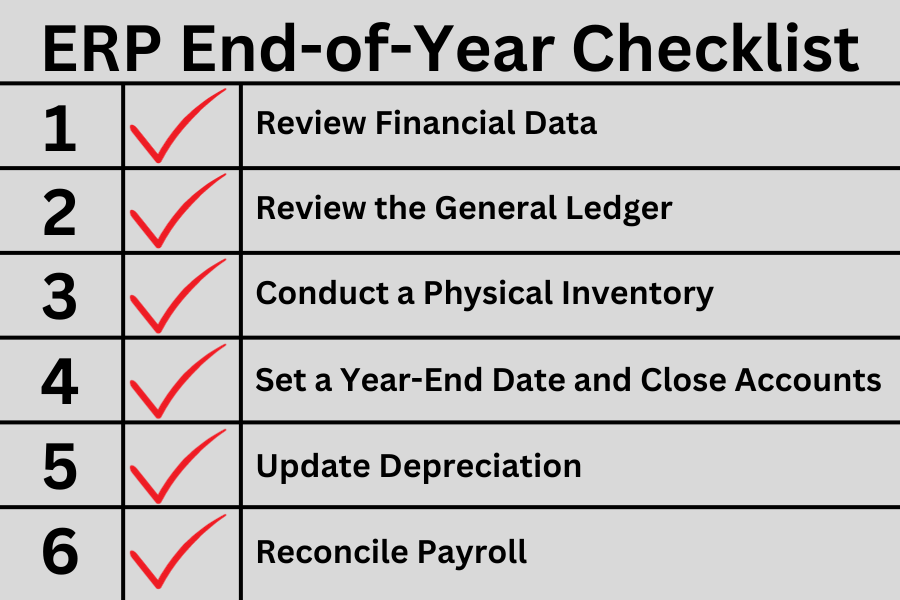

Step 1: Review Financial Data

Verify that all transactions are recorded accurately. Check these against statements and records and track down any mistakes so you can correct them. Reconcile bank statements, credit cards, and other financial accounts and records.

Step 2: Review the General Ledger

Confirm that the general ledger is up-to-date, and all transactions are correctly categorized. Ensure that account balances are accurate.

Step 3: Conduct a Physical Inventory

If your company sells goods, it’s time for the year-end physical inventory. Barcode scanners with warehouse modules that integrate into the ERP system make this step easy and fast. Reconcile the inventory count with the system.

Step 4: Set a Year-End Date and Close Accounts

Communicate your year-end cutoff date to the entire company. Then, close out accounts payable, accounts receivable, and inventory.

Step 5: Update Depreciation

Review and update the depreciation schedule for fixed assets. If you added any new assets in the past year, review these and create a depreciation schedule. Ensure that depreciation expenses are accurately recorded.

Step 6: Reconcile Payroll

Verify employee payroll records and reconcile them with financial statements. Confirm that all employee information is accurate. Note any unpaid sick leave or vacation time and carry it over or adjust it.

Step 7: Calculate Taxes

Calculate any taxes—including payroll taxes—due for the previous year. Verify that all necessary tax forms and reports are generated and filed.

Step 8: Review Customer and Vendor Balances

Are there any with outstanding issues or unpaid invoices? Address these issues now and make necessary adjustments or notes in the system. Be sure that all payments and receipts are recorded.

Step 9: Conduct a Bad Debt Review

Review any outstanding receivables and take note of potential bad debts. Decide whether you will carry them over into the new year. Make necessary adjustments to the allowance for bad debts.

Step 10: Back Up Data

Although cloud ERP systems often include automatic backups, it’s a good idea to make an onsite backup, too.

Step 11: Perform System Maintenance

You may need to perform updates and routine maintenance on your ERP, which could include updates, patches, and security updates.

Step 12: Review the Budget

Evaluate the previous year’s budget and adjust the budget for the upcoming year based on the previous year’s review.

Step 13: Train Employees

Schedule employee training sessions for new employees as well as refresher training on system updates or changes that will be implemented in the new year.

Step 14: Create Year-End Financial Statements

Run your year-end financial statements, including the balance sheet, cash flow statement, and income statement. Review and verify the accuracy of these statements.

Step 15: Discuss the Financials

Set aside time to meet with stakeholders to review financial statements and progress towards goals. Schedule time with employees to review the finances, and also set time with external parties to discuss any changes in payment schedules and invoicing in the new year.

Step 16: Review Internal Controls

Conduct a security review of the ERP system and update internal controls, processes, and documentation around handling finances or permissions. Review personnel who have access and adjust permissions if needed. Remove any access for people who have left the company or vendors whose contracts have ended.

Step 17: Document EOY Procedures

You don’t want to have to recreate your EOY process from scratch next year. Write down everything you did this year and make it easily accessible.

Is Your Software Up to the Task?

If you haven’t yet implemented an ERP at your company, you’re missing out on a huge opportunity to increase profitability and efficiency. Contact us or schedule your free consultation today to learn how the experts at ASI can help you take your software to the next level.